schedule c tax form meaning

The Schedule C tax form is used to report profit or loss from a business. If you have a loss check the box that describes your investment in this activity.

A Schedule C form is a tax document filed by independent workers in order to report their business earnings.

:max_bytes(150000):strip_icc()/10402021-4522fd0d0a6d4ce392d3fd952db762fd.jpeg)

. This is where Schedule C starts to look like a tax form rather than a straightforward information document. Schedule C of Form 1040 is a tax document that must be filed by those who are self-employed. That profit or loss is then.

However you can deduct one-half of your self. IRS Schedule C Profit or Loss from Business is a tax form you file with your Form 1040 to report income and expenses for your business. You will need to file Schedule C annually as an attachment to your Form 1040.

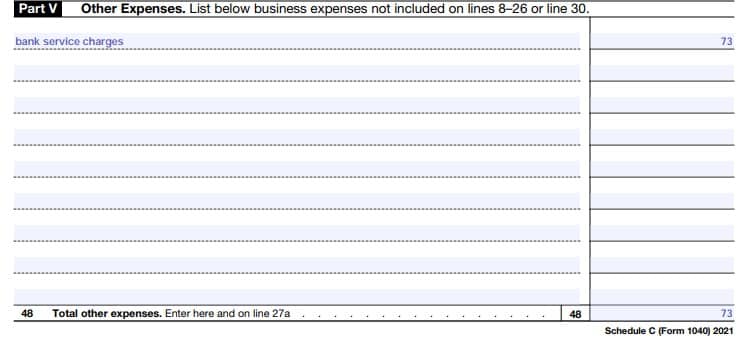

It is a form that sole proprietors single owners of businesses must fill out in the United States when. Schedule C Form 1040 may even help you find new deductions you werent aware ofdeductions that will put real dollars in your pocket. If you checked 32a enter the.

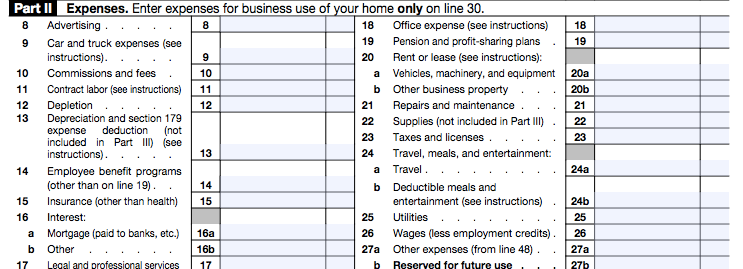

Many times Schedule C filers are self-employed taxpayers who are just getting their businesses started. There are clear instructions in lines 3 5 and 7 but here. Schedule C is used by small business owners and professionals who operate as sole proprietors to calculate their profit or loss for the tax year.

The Schedule C tax form is not for. Go to line 32 31 32. The quickest safest and most accurate way to file is by using IRS e-file either online or through a tax.

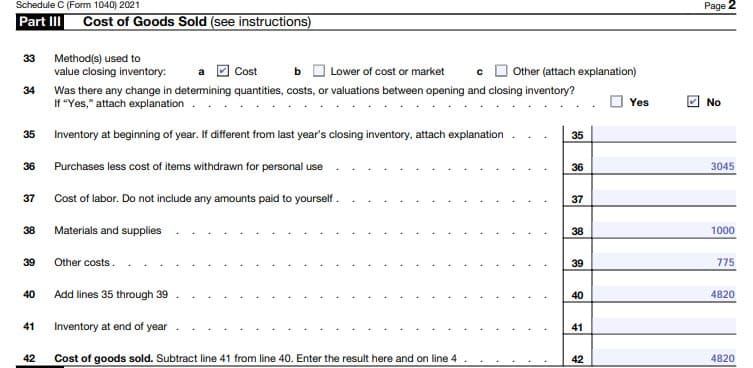

Report your income and expenses from your sole proprietorship on Schedule C Form 1040 Profit or Loss from Business Sole Proprietorship. Schedule C is the form used to report income and expenses from self. Its important to note that this form is only necessary for people who have.

This is where self-employment income from the year is entered and tallied. Schedule C is for two types of business a sole proprietor or a single-member LLC that hasnt elected to be taxed as a corporation. If the total of your.

Use Schedule C Form 1040 to report income or loss from a business you operated or a profession you practiced as a sole proprietor. The resulting profit or loss is typically. Form 1041 line 3.

You can also use this book in. If a loss you. An organization that answered Yes on Form 990-EZ Part V line 46 or Part VI line 47 must complete the appropriate parts of Schedule C Form 990 and attach Schedule C to Form 990.

How To Fill Out Schedule C For Business Taxes Youtube

:max_bytes(150000):strip_icc()/ScreenShot2021-02-07at12.05.18PM-be978757a0b5431d8a4642626004cbb3.png)

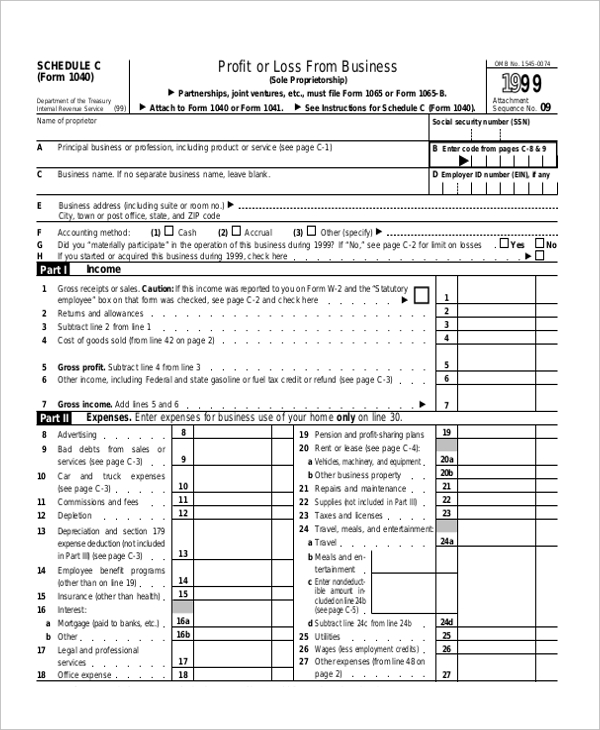

Schedule C Profit Or Loss From Business

What Is A Schedule C Stride Blog

What Is A Schedule C Tax Form Legalzoom

How To Fill Out Your 2021 Schedule C With Example

:max_bytes(150000):strip_icc()/1040-SR2022-44e2ed8aefeb4c65a07f875e2b3e173f.jpeg)

Form 1040 Sr U S Tax Return For Seniors Definition And Filing

How To Fill Out Your 2021 Schedule C With Example

What Is A Schedule C Tax Form H R Block

/ScreenShot2021-02-12at3.32.18PM-40b79df9059346d4aaef488825e16a46.png)

Schedule A Form 1040 Or 1040 Sr Itemized Deductions Definition

Business Activity Code For Taxes Fundsnet

/taxes-43933a0f9fe241c2acc5face7a724a3a.jpg)

Your Tax Refund Might Be Smaller This Year Here S Why

Free 9 Sample Schedule C Forms In Pdf Ms Word

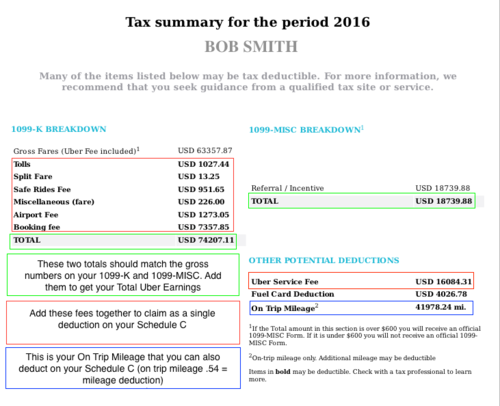

How To Use Your Uber 1099 K And 1099 Nec Stride Blog

:max_bytes(150000):strip_icc()/1099-NEC-e196113fc0da4e85bb8effb1814d32d7.png)

How To Report And Pay Taxes On 1099 Nec Income

What Does A 1095 C Delay Mean For 1040 Filings Integrity Data

Difference Between Nonprofit And Tax Exempt Mission Counsel

What Is A Schedule C Irs Form Turbotax Tax Tips Videos

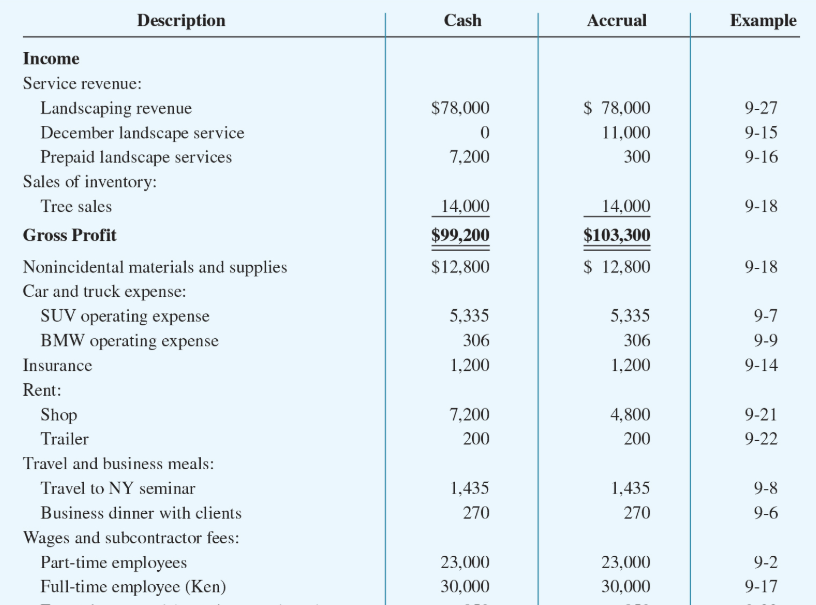

Solved Schedule C Form 1040 Profit Or Loss From Business Chegg Com

:max_bytes(150000):strip_icc()/Form1041Year2021-91aed92e44524bc99dbb7c21c1913264.png)